springfield mo sales tax rate 2020

The Missouri sales tax rate is currently. The base sales tax rate is 81.

Missouri Car Sales Tax Calculator

Exact tax amount may vary for different items.

. KY3 - The city of Springfield says its latest sales tax check is more than 1 million over budget. 052021 - 062021 - PDF. The Missouri statewide rate is 4225 which by itself would be among the lowest in the country.

Subtract these values if any from the sale. Did South Dakota v. This page will be updated monthly as new sales tax rates are released.

Rates may change at the beginning of the quarter. You can use the same process for figuring out your capital gains tax rate in most. Please note that you only pay taxes on the districts that apply to you not every levy.

15 lower than the maximum sales tax in MO. Qualifying food drugs vehicles and medical appliances are exempt from this tax. The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175 Greene County sales tax and 2125 Springfield tax.

Below is a list of the School Districts Fire Districts Cities and other taxing jurisdictions for which the Collectors Office collects property taxes. Print your own sales tax rate cards for all your business locations using this application. The current total local sales tax rate in Springfield MO is 8100.

072021 - 092021 - PDF. KY3 - Its almost time for Missouris 2020 tax-free weekend. According to the Missouri Department of Revenue certain.

The 2020 tax rate ceilings were determined based on the requirements of Section 137073 RSMo and Missouri Constitution Article X Section 22 commonly referred to as the Hancock Amendment. The sales tax holiday runs through Sunday August 9. You pay tax on the sale price of the unit less any trade-in or rebate.

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. What is the sales tax rate in Springfield Missouri. This is the total of state county and city sales tax rates.

Statewide salesuse tax rates for the period beginning May 2021. The minimum combined 2022 sales tax rate for Springfield Missouri is. Consumption at the rate of 25.

For other states see our list of nationwide sales tax. Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 9355. Christian County collects a 175 local sales tax the maximum local.

This percentage is derived from the current room tax rate and current sales tax rate. Over the past year there have been 73 local sales tax rate changes in Missouri. State Sales Tax - imposed on a sellers receipts from sales of tangible personal property for use or consumption at the rate of 625 The City receives 16 of the 625.

You can the plug in the numbers to the formula. There is no applicable special tax. The city of Springfields fiscal 2020 sales tax revenue came in roughly flat compared with the prior year.

Whether the proposed rates comply with Missouri law. You can print a 81 sales tax table here. Using this formula you will owe 89546 in capital gains taxes in Missouri for the 2020 tax yearTo find your actual amount simply consult the tax table to get the base amount plus the tax rate that applies to the rest of your capital gain.

The latest sales tax rates for cities starting with S in Missouri MO state. Click here for a listing of sales tax rate changes in the current quarter. Statewide salesuse tax rates for the period beginning October 2021.

The citys finance director David. 2022 Missouri state sales tax. Sales taxes are another important source of revenue for state and local governments in Missouri.

If either of those rates change this percentage will change. 042021 - 062021 - PDF. Including hotelmotel tax by 571 to arrive at the room rate figure and adding the appropriate sales tax to the new room rate.

This tax is imposed on general merchandise. However since counties and cities also levy sales taxes actual rates are often much higher in some areas reaching 10350. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply.

The December 2020 total local sales tax rate was also 8100. The County sales tax rate is. The Springfield sales tax rate is.

For tax rates in other cities see Missouri sales taxes by city and county. Statewide salesuse tax rates for the period beginning July 2021. 11 2020 at 604 PM PDT.

The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax financial institutions tax corporation income tax and corporation franchise tax. Missouri Sales Tax. The Christian County Sales Tax is collected by the merchant on all qualifying sales made within Christian County.

Rates include state county and city taxes. The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781. The city reported revenue of 466 million a less than 1 increase compared with 464 million in fiscal 2019 according to a news release.

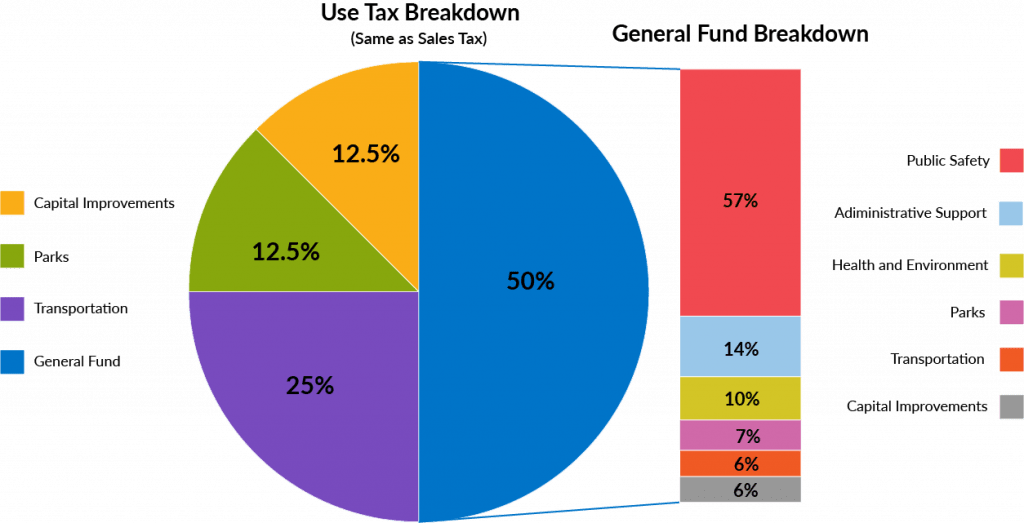

Each tax rate ceiling is determined annually and is adjusted to ensure revenue neutrality. Sales Tax Rate Cards. The city sales tax rate of 2125 includes a 1-cent General Sales Tax 14-cent sales tax for capital improvements 18-cent Transportation Sales Tax and 34-cent Pension Sales Tax.

This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175. Rates are current as of todays date. The Christian County Missouri sales tax is 598 consisting of 423 Missouri state sales tax and 175 Christian County local sales taxesThe local sales tax consists of a 175 county sales tax.

Missouri Income Tax Rate And Brackets H R Block

Sales Taxes In The United States Wikiwand

Use Tax Web Page City Of Columbia Missouri

Missouri Sales Tax Small Business Guide Truic

Missouri Sales Tax Rates By City County 2022

U S States With Highest Gas Tax 2022 Statista

Taxes Springfield Regional Economic Partnership

Georgia Sales Tax Rates By City County 2022

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Michigan Sales And Use Tax Audit Guide

Louisiana Sales Tax Rates By City County 2022

Monthly Financial Reports Springfield Mo Official Website

Harris County Tx Property Tax Calculator Smartasset

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand